Tom Ferry's Blog

Insights, Inspiration and Ideas

for Top-Producing Real Estate Agents

Tom Ferry's Blog

Insights, Inspiration and Ideas

for Top-Producing Real Estate Agents

Our Latest Posts

10 Time Management Tools Every Agent Needs

If you feel like there aren’t enough hours in the day, you’re not alone. Between lead gen, showings, negotiations, marketing, paperwork (ugh), and somehow maintaining a personal life, time can feel like the real estate agent’s worst…

Read MoreReal Estate Google Ads: The Best Types for Fast-Converting Leads

Let’s talk lead gen. You know as well as I do that real estate Google Ads are a goldmine for ready-to-go, bottom-of-funnel leads… if you use them the right way. But here’s the problem—too many agents are just throwing money at Google Ads…

Read MoreOther Blog Categories

- #TomFerryShow

- Appointment Setting

- Business Planning

- Coaching

- Events

- Expired Listings

- Featured

- Geographic Farming

- Goal Setting

- Keeping Current Matters

- Lead Generation

- Listing and Selling

- Luxury Real Estate

- Member Spotlight

- Mindset

- Objection Handling

- Online Marketing

- Open Houses

- Real Estate Events

- Real Estate Scripts

- Real Success

- Real Talk

- Reviews

- Sales Skills

- Social Media

- Success in Real Estate

- Summit

- Team Building

- Time Management

- Tips from Tom

- Tools and Training

- Work Life Balance

Would You Like to Generate and Convert

More Leads in Less Time?

Schedule a Free Coaching ConsultationBlog Articles

If you feel like there aren’t enough hours in the day, you’re not alone. Between lead gen, showings, negotiations, marketing, paperwork (ugh), and somehow maintaining a personal life, time can feel like the real estate agent’s worst…

Read MoreLet’s talk lead gen. You know as well as I do that real estate Google Ads are a goldmine for ready-to-go, bottom-of-funnel leads… if you use them the right way. But here’s the problem—too many agents are just throwing money at Google Ads…

Read MoreAs a real estate agent, your income isn’t just about closing deals—it’s about knowing how those deals translate into dollars. One of the most important financial metrics you’ll ever track in your business is gross commission income. If…

Read MoreAs a real estate agent, there comes a point where you realize you simply can’t do it all on your own. You’ve built a thriving business and nailed down your systems, but the day-to-day grind of managing administrative tasks, client communication,…

Read MoreA Brand Bible Solidifies Your Personal Brand If you want people to see you as the go-to expert in your market, it starts with consistency — and that means building a brand bible. A solid branding bible isn’t just about your logo or colors….

Read MoreWouldn’t it be nice to stop drowning in admin work and start focusing on what you do best—closing deals and building relationships? Hiring a real estate assistant is how you make that a reality. The right assistant can help you scale faster,…

Read MoreMarketing strategies, just like any other business asset, are best when diversified. The problem is, the more comprehensive your marketing playbook, the more difficult it can be to gauge how much you’re spending vs. how much you’re making. That…

Read MoreThe Key to Winning Real Estate Strategies: Run Plays That Work When it comes to growing a thriving real estate business, real estate strategies are everything. The top performers aren’t just lucky. They use repeatable, proven actions: what I…

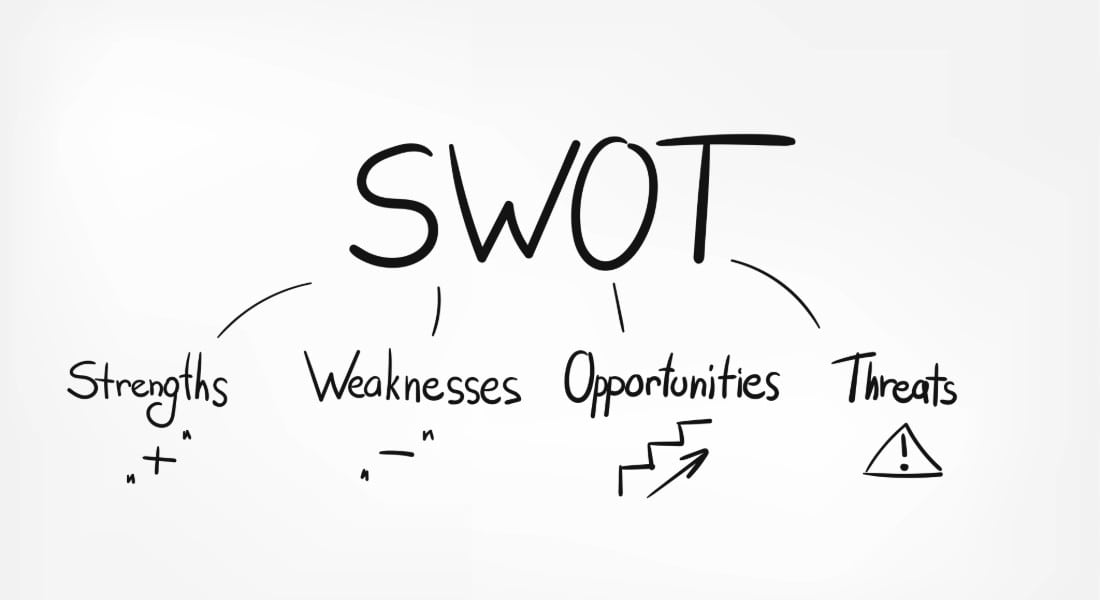

Read More6-8% of the people in your database will buy or sell a home in the next 380 days. To capitalize on this, you need to go all in on maximizing your opportunities and ramping up your marketing, and that starts with a SWOT analysis. Doing a SWOT…

Read MoreBuild Your Financial Future Through Diversification You’re no longer just a business owner; you’re a leader in your field who is beginning to develop multiple sources of income apart from your primary revenue stream. At Level 7 of the 8 Levels…

Read MoreEvery year, as the snow melts and the flowers bloom, buyers and sellers flood the market. But success goes to the agents who plan ahead, build momentum, and follow a powerful marketing calendar. The question isn’t “Will the market be strong?”…

Read MoreHow to Write a Business Plan with Marketing & Tracking Welcome back to your real estate business planning prep! In last week’s blog, we laid the groundwork for how to write a business plan by focusing on the foundational elements that set the…

Read MoreMost Popular

The Hour-By-Hour Plan For A Real Estate Agent’s Perfect Day

One of the benefits to being a real estate agent is the freedom that this business gives you.

There’s no time clock to punch or strict hours to abide by. You have the freedom to work whenever and wherever you choose.

Read More

The Hour-By-Hour Plan For A Real Estate Agent’s Perfect Day

One of the benefits to being a real estate agent is the freedom that this business gives you.

There’s no time clock to punch or strict hours to abide by. You have the freedom to work whenever and wherever you choose.

Read More

Top 10 Objections and the Scripts to Overcome Them

The truth hurts …

So when I ask if you want to know a secret about sales, I have to warn you that you might not like the answer.

Read More

Top 10 Objections and the Scripts to Overcome Them

The truth hurts …

So when I ask if you want to know a secret about sales, I have to warn you that you might not like the answer.

Read More

Real Estate Scripts: My NEW Best Response for “How’s the Market?”

Things change in this industry all the time.

But since at least 2009, I’ve stuck with a script I feel is the best response to the question you probably hear five times a day, if not more: “How’s the market?”

Read More

Real Estate Scripts: My NEW Best Response for “How’s the Market?”

Things change in this industry all the time.

But since at least 2009, I’ve stuck with a script I feel is the best response to the question you probably hear five times a day, if not more: “How’s the market?”

Read More